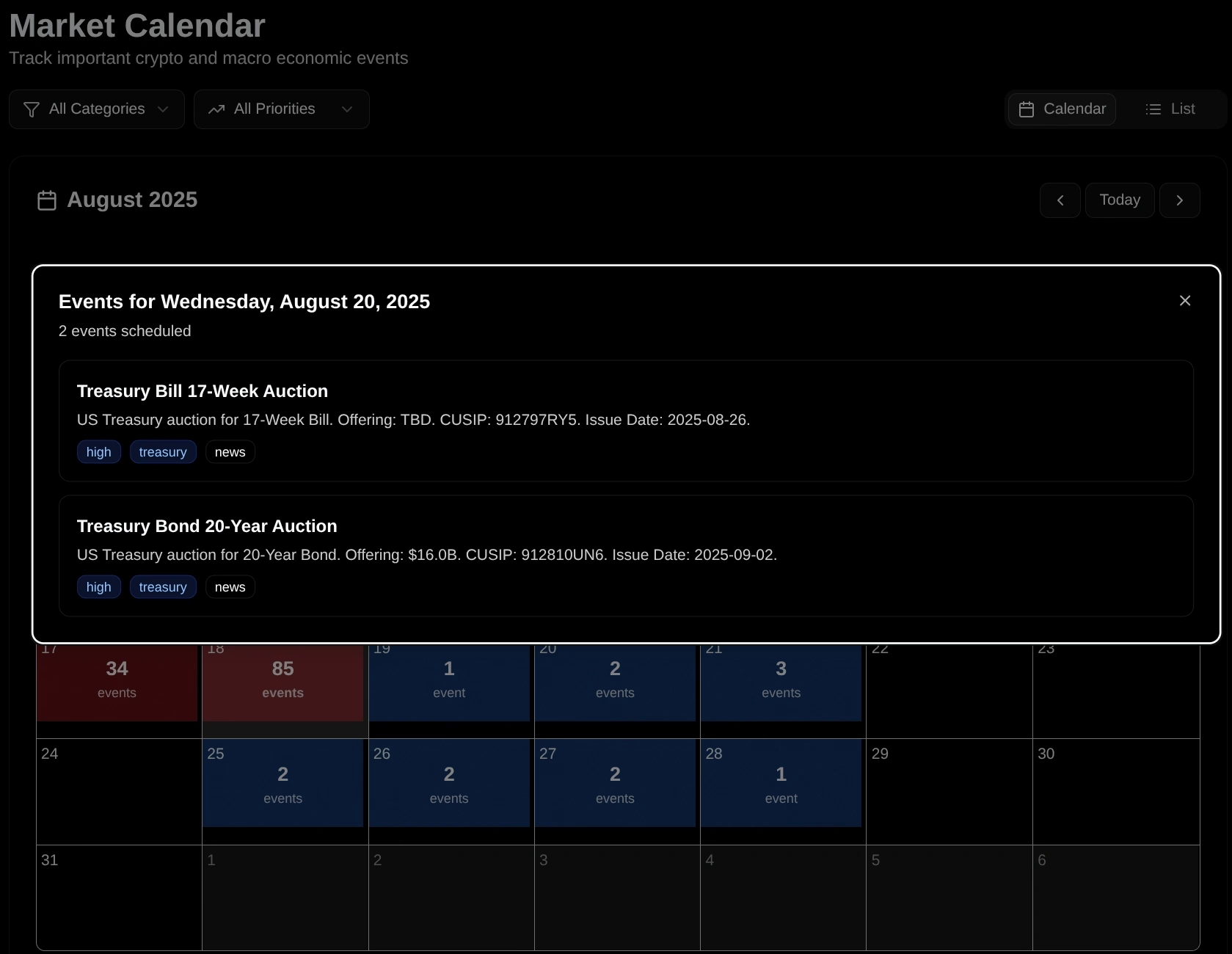

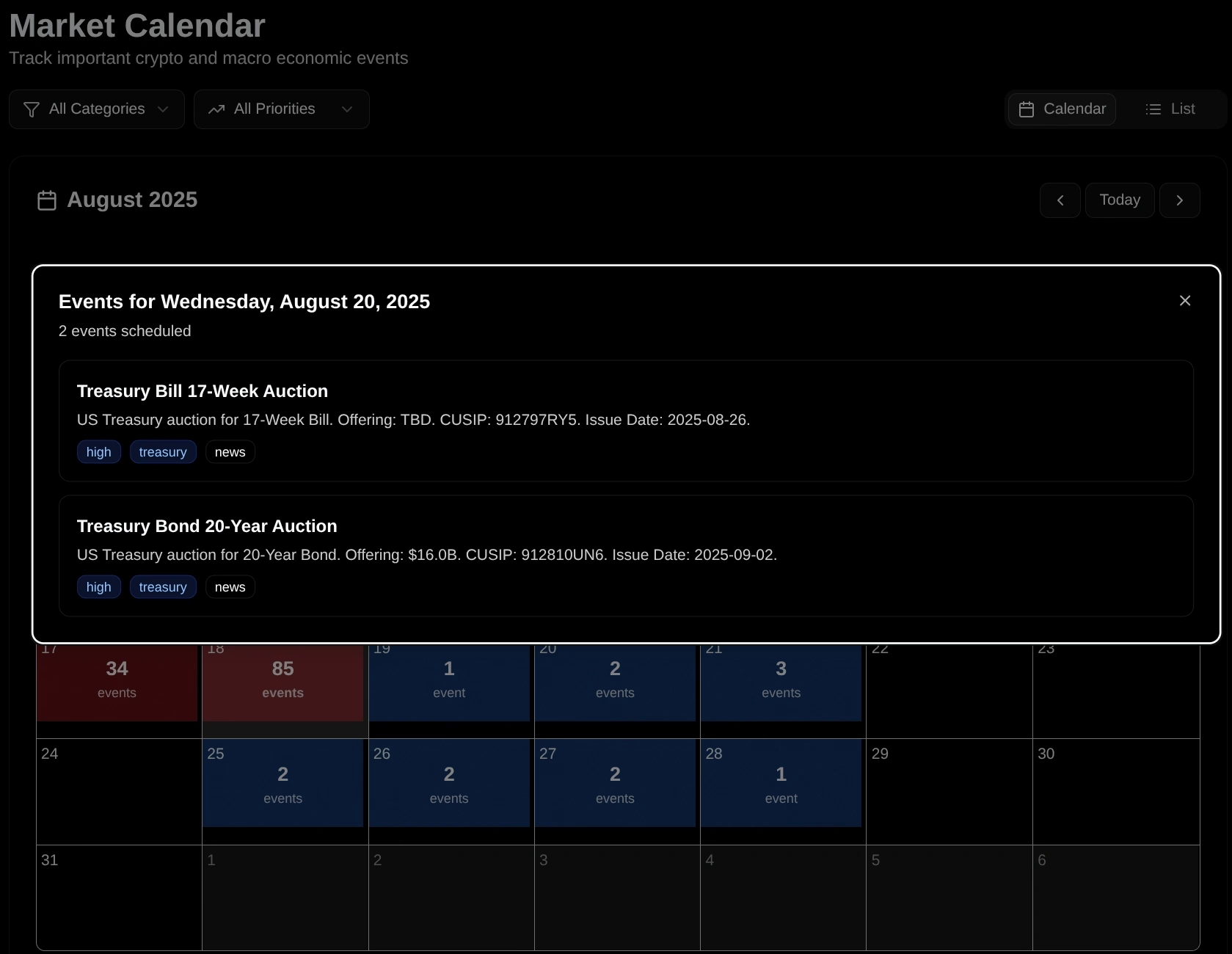

Economic Calendar

Track macro events that can move crypto, filtered to what matters.

Know when to buy, when to wait, and how much to allocate.

RJALPHA helps investors, traders, and busy professionals turn data into clear allocation decisions.Use one weekly-and-daily process to protect capital and grow it over time.

Choose the path that fits your time. Same core system, different depth.

Build core positions over months and years with clear sizing and risk checks.

Run the base system weekly and daily, then use extra tools for entries, sizing, and risk.

One short daily check and one deeper weekly review. Stay aligned without living in charts.

When feeds conflict, people freeze, chase late, size too big, or sit in cash too long.

Know when to buy, when to wait, and how much to allocate.

Move idle cash into assets you can own with a repeatable plan and risk checks.

I waited too long, then chased the move.

I had a view, but no plan for position size.

I spent hours on X and news feeds and still had no clear action.

Results improve with process, not prediction.Use data, risk controls, and consistent execution.

Clear actions. Less guesswork. Fewer mistakes.Protect downside first, then compound upside over time.

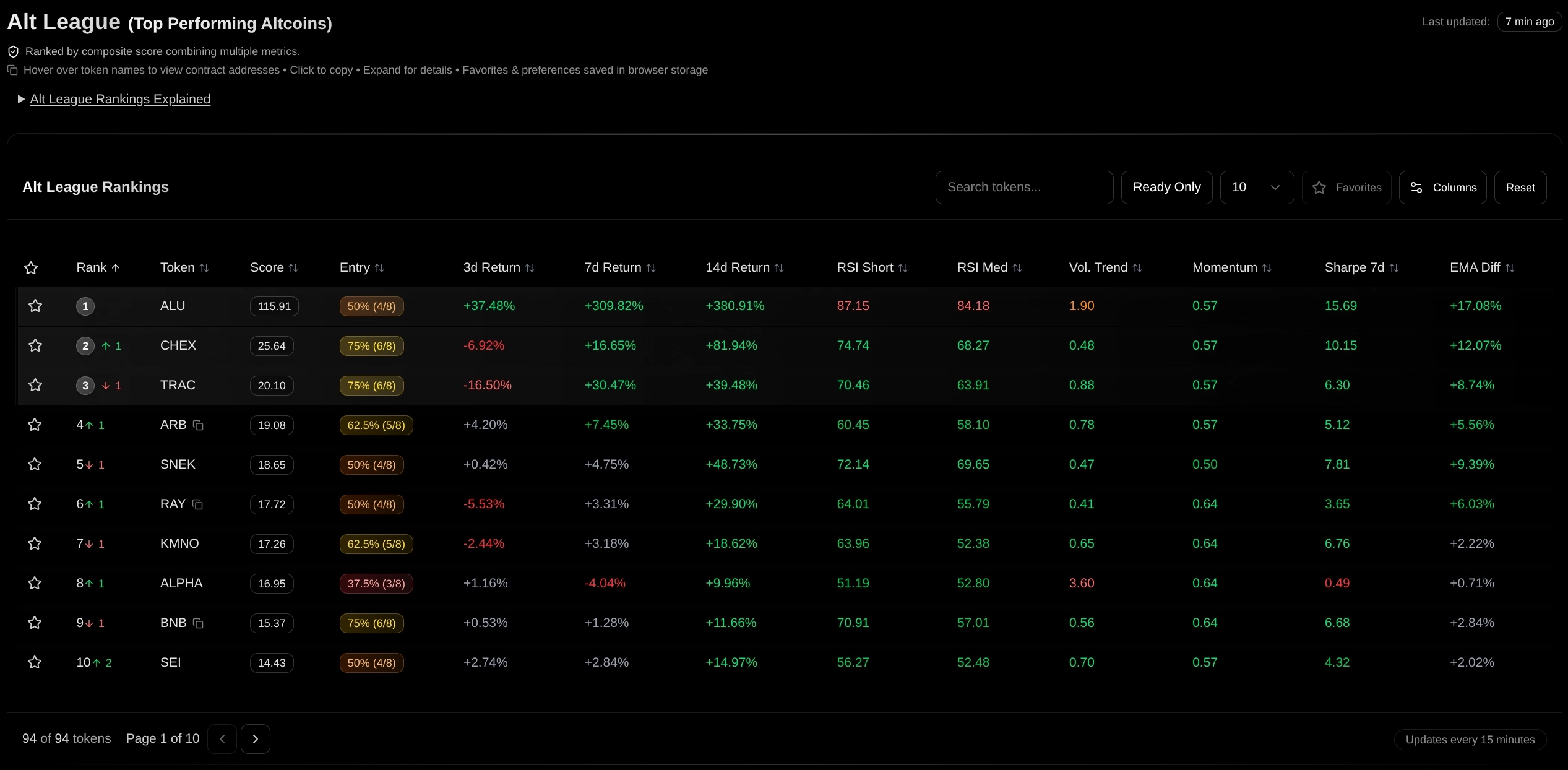

Alt League ranks higher-risk alts.

Global Liquidity Index shows liquidity direction early, helping you make clearer entry and exit decisions.

Market State and Regime show when to be aggressive and when capital protection comes first.

Alt League ranks alt setups so you can rotate with structure instead of chasing late moves.

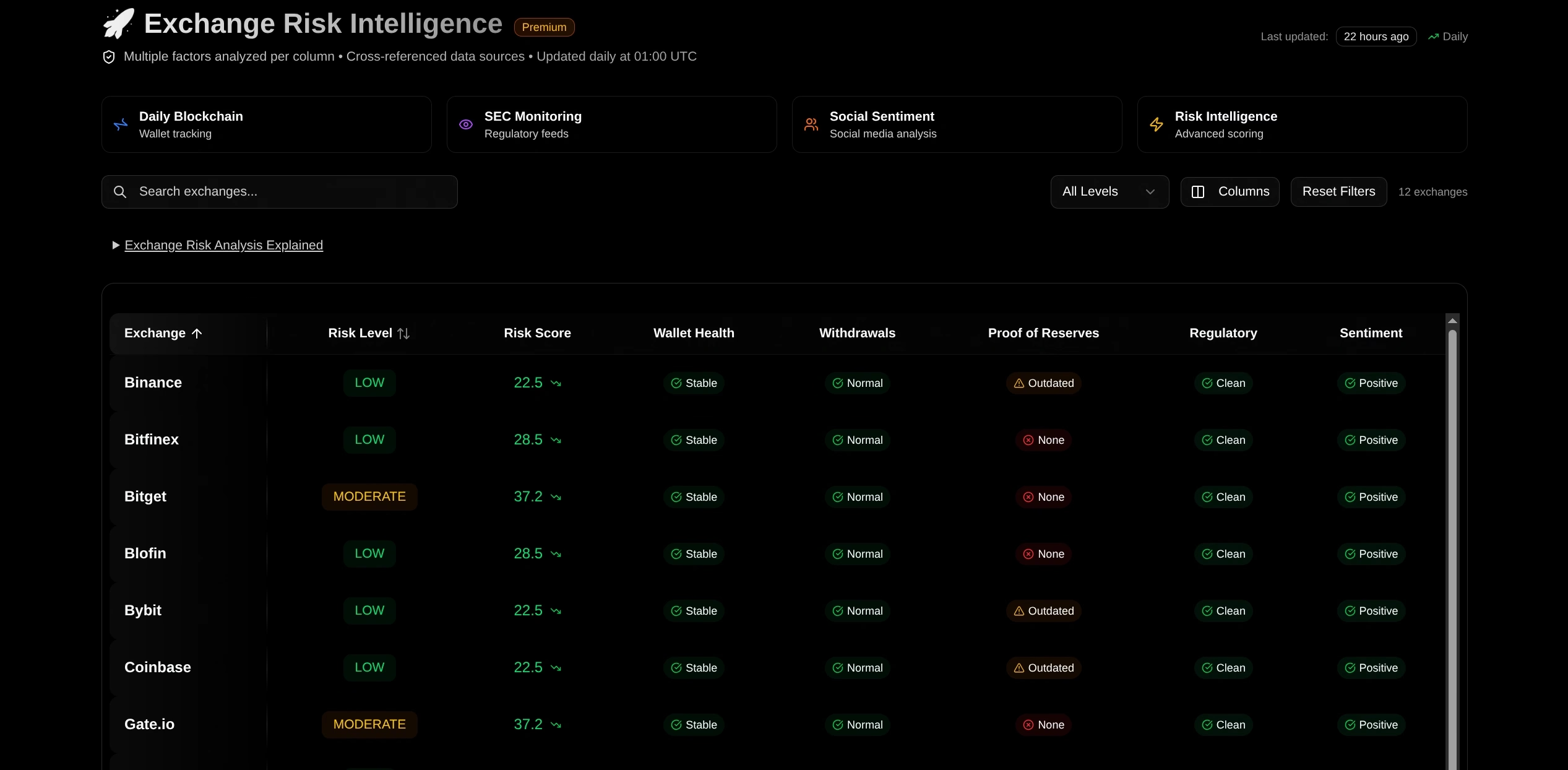

Monitor exchange and stablecoin conditions so you can reduce exposure when risk rises.

See how each path turns data into one clear next move.

Charts, risk monitoring, reports, and market intelligence — everything you need to invest well, in one place.

Track macro events that can move crypto, filtered to what matters.

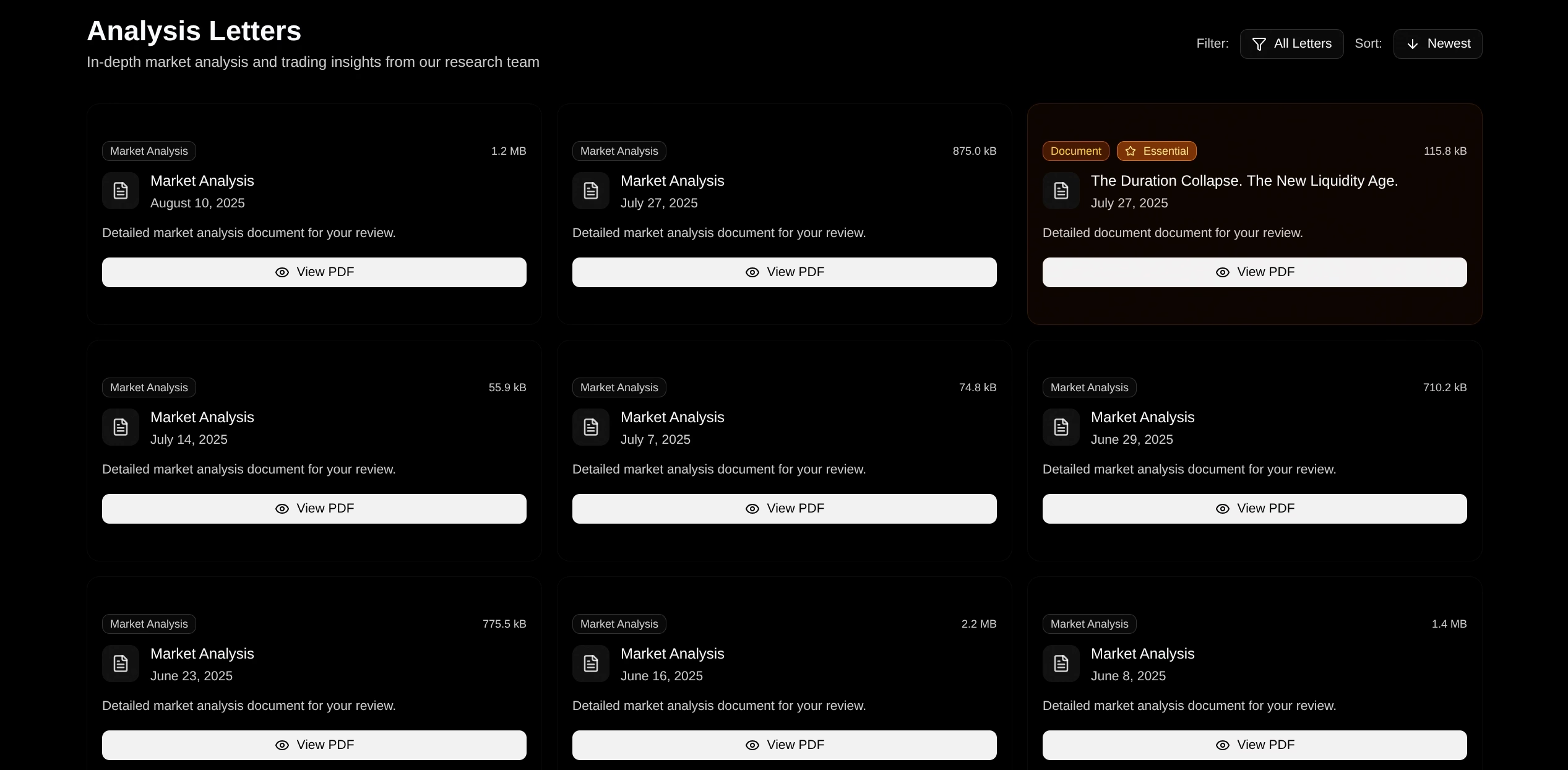

Get a concise weekly read on what changed, what matters now, and what to watch next.

Monitor exchange and stablecoin risk in one place before allocating size.

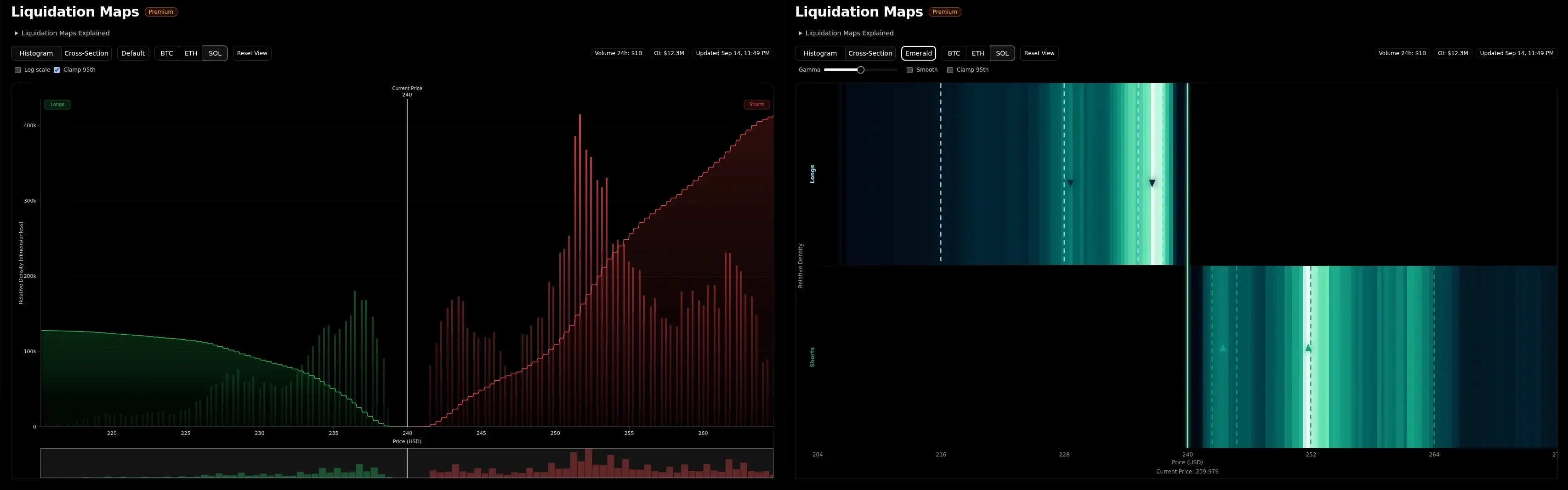

See likely liquidation zones and potential price magnets to improve entries, exits, and risk control.

Unedited feedback from members.

"Alright I'm back up and running thanks a lot! The alt league table is the real deal. Up 100% the past 2 days. Appreciate you 🫡"

"I mean you're a staple in my daily analysis and actions when it comes to investing since you cover so many fundamental and valuable things, might be the only dashboard I need NGL! Since you take care of long term, medium term, alts and now memes."

"Hey mate just wanted to reach out to let you know how grateful I am for your research & RJ Dash. Your insights & analysis has made a considerably difference to the way I now approach the market & my portfolio reflects that. Cheers again for all the hard work you've put in."

"This is great Rob, thank you very much, I cant tell you how good your dashboard is 🔥 we can see into the future lol"

See each step from trial to your first allocation decision. You stay in control.

Pick a plan and start your 3-day trial. Charges start after trial. Cancel before then and pay nothing.

Sign up with Google, email, or X in under a minute.

Pick your path: long-term, active, or busy. Start with core signals and add tools as needed.

Use alerts, weekly letters, and AI chat to catch up fast without tracking every feed.

Use HODL, dominance, regime context, and risk checks to decide when to buy, wait, or reduce risk.

Protect downside first, then compound upside over time.

3-day trial on both plans. No charge until trial ends. Cancel anytime.

Start your 3-day trial and follow a weekly-and-daily process you can stick to.

Cancel before your 3-day trial ends and pay nothing.